CAREER VITAL SIGNS

INTRO

When assessing a patient’s state of wellness or illness, one of the most important things that we collect are the vital signs: temperature, heart rate, blood pressure, respiratory rate, oxygen saturation, weight, height, BMI + pain level. These help us clinicians to make our diagnosis, establish a treatment plan and predict the prognosis. Given that use this for our patient care, might it be possible to adapt this to our own career vital signs? I think so.

I’ve been thinking about this concept a lot, and mostly it comes down to how important objective information can be. Our perceptions (subjective) can sometimes be incongruent with our reality (objective). It’s like when a patient says that their pain is 10/10 and is telling you this as they text their friends and eat McDonald’s (apparently that pain didn’t stop them from hitting the drive-through). Or, on the opposite end of the spectrum, we sometimes see that the stoic 75-year-old’s vital signs are garbage, as they swear that they feel fine, only for us to find they are on their way to Urosepsis land.

We at The PA Blueprint have dedicated our whole business to educating our current and future PA-C colleagues, as well as other medical professionals. One way in which we accomplish this is by encouraging others to first assess their current situations, before being able to devise a plan to optimize/improve. We need to be able to quickly assess our careers, and in a way that minimizes the subjective (given 50% or more of us are burned out) and just gives us the cold, hard data.

So, I’ve developed the concept of Career Vital Signs, and I will explain the individual components and how to best use them below:

- FINANCIAL HEALTH INDEX (aka Net Worth)

- CASH FLOW

- BURNOUT SCORE

- JOB SATISFACTION SCORE

FINANCIAL HEALTH INDEX

(aka NET WORTH)

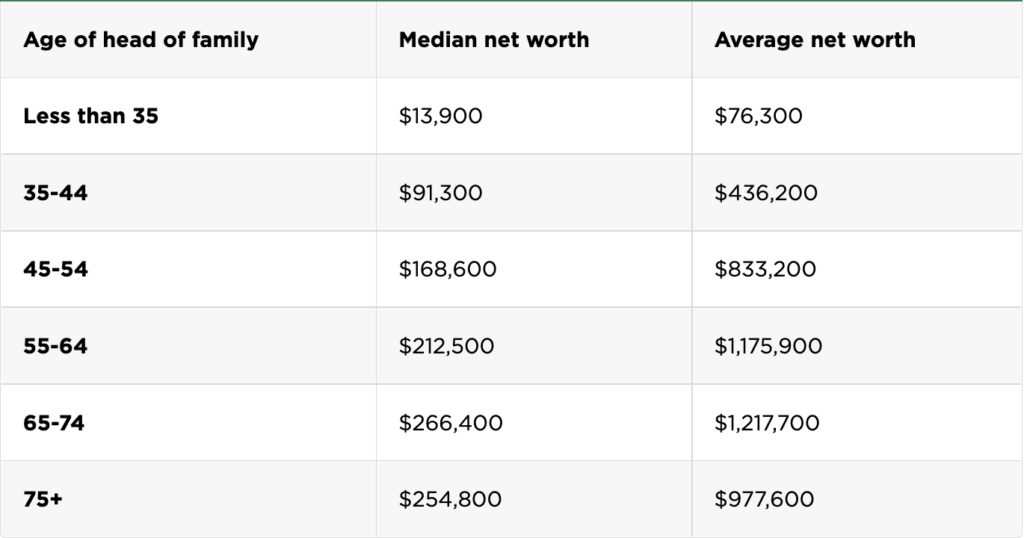

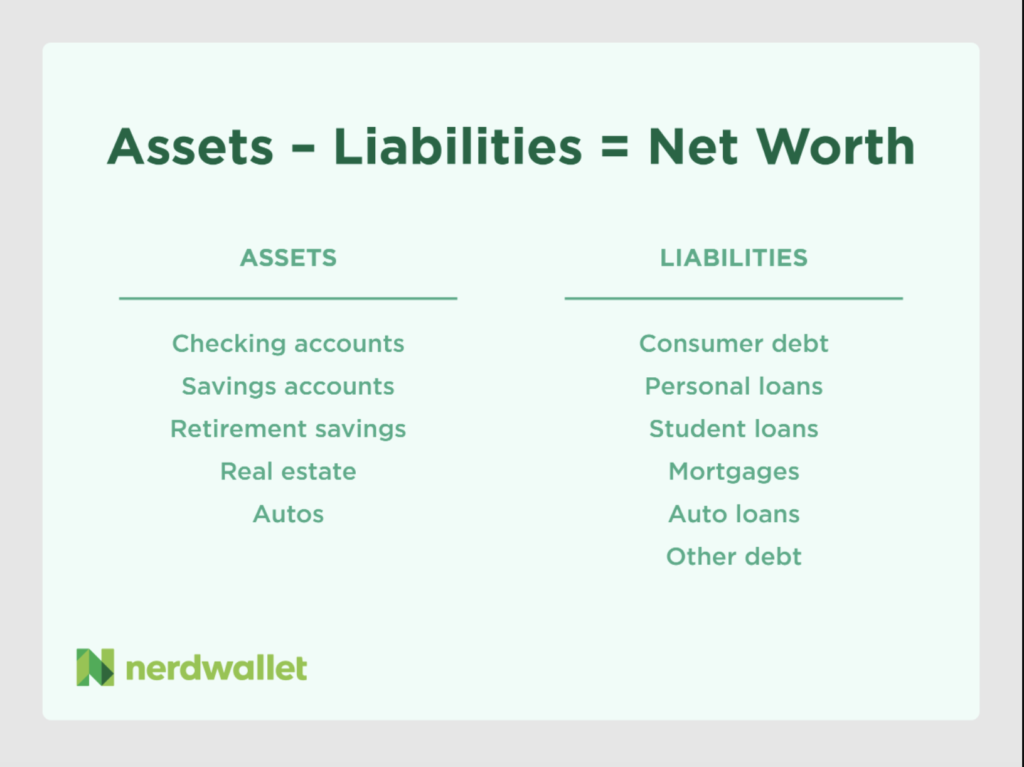

Just like we use weight and height to calculate out the Body Mass Index (BMI), we can use Assets and Liabilities to calculate out Net Worth, which I’m referring to as Financial Health Index (FHI). But what does this mean?

“Net worth is assets minus liabilities. Or, you can think of net worth as everything you own less all that you owe.”

NerdWallet

ASSETS

“Assets: Assets include cash — such as in your checking, savings and retirement accounts — and items such as cars, property and investments that you could sell for cash. These are often referred to as liquid assets.

Some fixed assets can count toward your net worth calculation, too, provided you can or would sell them if needed. For example, your home would count toward your net worth if you’re willing to use it for a home equity line of credit or sell it should the need arise.”

NerdWallet

LIABILITIES

“Liabilities: Any money you owe to another person or entity falls under this category. That includes revolving consumer debts — such as credit card balances — as well as personal (including student loans), auto, payday and title loan balances. If you’re using your home as an asset, its mortgage counts as a liability as well.”

NerdWallet

Fresh out of PA school, your Financial Health Index is likely to be about as ugly as it will be throughout your entire life, given the amount of student loans that you’ve taken on. This is expected and is normal, and my FHI was about -$160,000 when I graduated and started my first PA job! To calculate your FHI, use either this calculator from NerdWallet or sign up for a free Personal Capital account.

To see if your FHI is looking more healthy than septic, compare your score to the following:

So, how’s it looking so far? Are you looking financially sick or not sick? If you’re a new grad, you should expect that you’ll be showing some abnormal vitals at this point in your career. But, with a solid financial treatment plan, such as that from Ramit Sethi, you’ll be able to turn this around within a few years.

CASH FLOW

Yes, this is yet another career vital sign related to financial health. Why? Because financial health, including how your money moves month-to-month and year-to-year will directly impact your life and career, perhaps more than any other factor. A healthy cash flow will give you a positive prognosis on your Financial Health Index (aka Net Worth), as well as allow for a freedom of career choices (think better Burnout and Job Satisfaction scores discussed below).

Cash Flow has the potential to compensate for a crappy FHI, similar to how blood pressure and heart rate work in concert, as a positive Cash Flow can work hard for you until that FHI can stabilize and normalize over time. For example, my family’s FHI was about -$250,000 just 4 years ago, and is now +$250,000 thanks to a frugal but fulfilling lifestyle, positive Cash Flow and smart financial moves.

Cash flow is easily calculated by the following formula:

INCOME – EXPENSES = CASH FLOW

We know that the higher that your savings/investing rate is, the faster you’ll be able to become financially independent. At bare minimum, you’ll need to be “in the black”, aka Cash Flow positive, to keep your head above water. If you are not, and find yourself “in the red” each month, your Cash Flow vital sign will be and stay in the toilet. Preferably, you save and invest 20% or more on average each month.

Within the first 2-3 months of my first PA job, I wondered why I wasn’t able to save more money, only to realize that my expenses were greater than my income. I was “in the red”, with a negative Cash Flow, and on my way to coding financially!

While I can’t find any specific monthly or yearly averages on this, I’ve created one below, sticking with our vital signs theme:

| CASH FLOW (monthly $) | STATUS |

| >2000+ | MEDICAL MARVEL |

| 1000-2000 | APPEARS YOUNGER THAN STATED AGE |

| 0 – 1000 | NON-TOXIC, APPEARS WELL |

| 0 | STABLE |

| -1 – 1000 | ON LIFE SUPPORT |

| -1000 – 2000 | DECOMPENSATING |

| -2000+ | CODING |

So how do you easily calculate Cash Flow? I suggest you sign up for a free Personal Capital account, as one of the many features is to do just that, and it is a lot easier than maintaining spreadsheets.

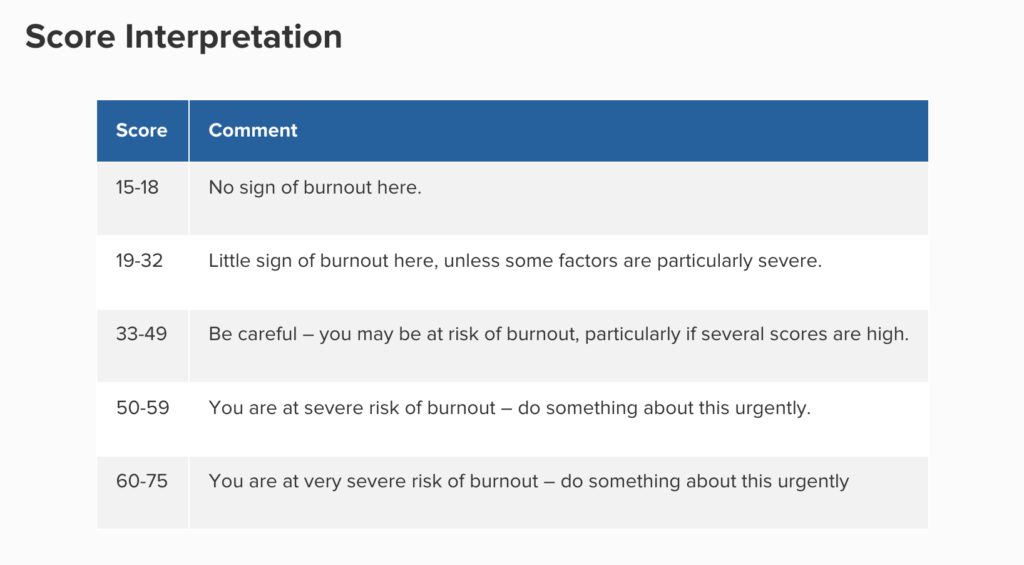

BURNOUT SCORE

There it is: the dreaded “B word.” You knew this was coming. We can think of burnout as being similar to the pain scale that we ask our patients to quantify for us. While it’s more subjective than objective, it is still vitally important to assess our career well-being.

The best place to check your Burnout Score is with this free “Burnout Self-Test” from MindTools. Once you do so, compare yourself with the following:

So, how good or bad is it? Better or worse than you expected? Pain out of proportion to exam? Are you extra-crispy, pandemic-fried or actually doing okay?

I think that we have done an extraordinary job in discussing all aspects of Burnout, from the basic understanding to assessments to the treatment and prevention of it, within The PA Blueprint Ebook. We encourage you to check that out HERE to learn more.

JOB SATISFACTION SCORE

It may be hard to accurately tease out your level of job satisfaction if you are burned out currently, but I encourage you to do it anyways as another Career Vital Sign. For example, you could be feeling burned out due to a particularly busy few weeks at work, yet overall still enjoy your job.

While I couldn’t find a free version of an online job satisfaction survey for you to use, let’s just use a 1-10 scoring scale for this (1 = worst, 10 = best). When quantifying your job satisfaction score, factor in all of the following:

- Support

- Patients that you work with

- Hours

- Compensation

- Potential for career advancement

- Life-Work Balance

- Logistics (commute time, EMR used, etc.)

With all of those factors in mind, try to pinpoint where you fall on this scale that I’ve created:

| WORST | BEST | ||||||||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| “I hate my job.” “I’m likely to leave soon + am already looking elsewhere.” | “I love my job.” “I can see myself staying here for many years.” |

Ok, so how’s that vital sign looking? Is it reassuring or causing you to do some reassessing?

SCORING EXAMPLES

Let’s take a look 4 hypothetical scoring examples, and break those down:

THE SWEET SPOT

Optimally, your career vitals would look similar to this:

- FHI: above average

- CASH FLOW: positive

- BURNOUT SCORE: 15-32

- JOB SATISFACTION SCORE: 6-10

This scenario demonstrates someone who is rich in money AND happiness, so they should consider staying the course at their current job and making the most of it. The grass might not be greener elsewhere.

THE BURNOUT

You should consider switching jobs if your scoring is similar to this:

- FHI: above average

- CASH FLOW: positive

- BURNOUT SCORE: 50-75 (H)

- JOB SATISFACTION SCORE: 1-4 (L)

This scenario demonstrates someone who is money rich and happiness poor, so they should consider switching to a more satisfying job, even if it means taking a small pay cut to find a better balance. This example brings to mind someone who trades money for joy, and is not passionate about their work, only collecting the next paycheck.

THE MEDICAL MARTYR

You should consider a financial overhaul if your scoring is similar to this:

- FHI: below average (L)

- CASH FLOW: negative

- BURNOUT SCORE: 15-32

- JOB SATISFACTION SCORE: 6-10

This scenario demonstrates someone who is happiness rich and money poor, so they should consider working on their financial lives, as they should keep the job that they enjoy while also being able to meet their financial obligations. This example brings to mind someone who is following their passion, but doing so at the sacrifice of their financial health.

THE CAREER CARCINOMA

You should consider a COMPLETE CAREER OVERHAUL if your scoring is similar to this:

- FHI: below average (L)

- CASH FLOW: negative

- BURNOUT SCORE: 50-75 (H)

- JOB SATISFACTION SCORE: 1-4 (L)

This scenario demonstrates someone who is both happiness AND money poor, which is a recipe for disaster, with a high likelihood of very bad professional and personal outcomes. This example brings to mind a new graduate that has no financial acumen and has also found themselves in a hostile and unsupportive workplace. Someone in this position feels stuck because of their financial situation, so improving their FHI and Cash Flow may be one of the best places to start. Overall, this person needs all sorts of help, and should consider digging themselves out of this hole via self-education (career + financial), coaching/mentoring and having faith that there is a better way.

So, which scenario do you best relate to: The Sweet Spot, The Burnout, The Medical Martyr or The Career Carcinoma? After creating and reviewing these, I see myself having traveled this path within the 10 years of my career:

THE CAREER CARCINOMA –> THE MEDICAL MARTYR –> THE BURNOUT –> THE SWEET SPOT

Keep in mind that you don’t have to “pay your dues” by starting at such a terrible place with your career vital signs not being compatible with life. These scenarios are not train stops or phases that you have to pass through to get to your sweet spot, so I encourage you to educate yourself as much as you can in order to find the life-work balance that you want and deserve.

THE BIG PICTURE

Alright, so I’ve given you a new way to evaluate your career via the vital signs discussed above. One of the beautiful things here is that you can assess and reassess as often as you would feel it necessary, just like we collect data points with the vitals of our patients. In fact, having multiple data points may allow you to see trends, and determine if something is acute or chronic.

I encourage you to tally up your score and just get a general feel for where you are landing. Does the prognosis look grim or positive? If grim, what’s your plan to help yourself (which could be to ask for help)? Just like we recommend to our patients, maybe do a recheck on this after 3 months with your treatment plan. If positive, you’ve been given a clean bill of health for now, and let’s hope that things stay that way. Consider doing an annual recheck to make sure things are still looking healthy.

Thinking back to the beginning of my 10 years in practice, I know that my Career Vital Signs would’ve landed me in the career ICU. But, with a little time, energy and financial investment, I’m happy to report that we’ve made a full recovery, and we’re on the fast-track to financial independence and an optimal life-work balance.

I do wish that I had had a tool to objectify the state of my career, as the ability to rapidly assess my status would’ve been invaluable. Instead of having to slowly and painstakingly have my vitals be revealed to me over years, I would’ve been able to quickly assess and triage what problems I had, which would’ve led to more timely interventions. Just like with physiologic sepsis/carcinoma, career sepsis/carcinoma has a much better prognosis when caught early.

Well, given that such a tool did not previously exist, I’ve created this: Career Vital Signs. I hope that you find it practical and valuable, and that routine check-ups with this tool might help catch any career pathologies before they progress and metastasize.

DISCLAIMERS: 1) The views expressed here are our own and do not necessarily represent the views of our employers. 2) We don’t know what we don’t know. Feel free to message us if you don’t agree with something that you read. 3) We do have affiliate agreements with companies. By clicking on our links and making any purchases, we may earn some money on those generated sales. We also will earn some money by purchasing the books via the links above.